Did you know that over 6 million car accidents occur in the United States every year? Such a staggering number underscores the importance of understanding your rights. Navigating the complexities of car accident laws and the insurance claims process post-accident can be daunting. This is where attorney advice for car accident insurance proves invaluable. Grasping what you are entitled to can significantly impact your recovery and compensation.

This article will guide you through the essential aspects of your rights after an accident, emphasizing the importance of attorney guidance in understanding your legal standing. You will discover practical steps to take immediately following an accident, the intricacies of filing claims, and how to effectively deal with insurance companies. Whether you aim to claim your rightful compensation or simply wish to understand the legal landscape better, this guide offers a comprehensive roadmap to help you navigate the post-accident process with confidence.

Key Takeaways

- Over 6 million car accidents occur annually in the U.S.

- Understanding your legal rights is essential for adequate compensation.

- Attorney advice can guide you through complicated car accident laws.

- Knowing the insurance claims process can protect your interests.

- Immediate steps after an accident are critical for your case.

- Effective communication with insurers can enhance your claim outcome.

- Engaging a qualified attorney can simplify legal complexities.

What to Do Right After a Car Accident

The aftermath of a car accident can be daunting, yet understanding the immediate actions to undertake can be transformative. Timely intervention is paramount for capturing essential details pertinent to car accident laws. Below, we outline critical procedures to adhere to post-incident.

Check for Injuries

Initiate by assessing injuries among all parties involved. Prioritize safety over property damage assessment. If injuries are detected, immediate medical assistance is imperative. Familiarity with medical expenses coverage can mitigate stress during the recovery process.

Contact Emergency Services

In the event of injuries or substantial damage, emergency services must be contacted. This guarantees the presence of medical professionals. Additionally, a police report is invaluable for establishing the accident’s facts, crucial for compensation for damages.

Document the Scene

Collecting evidence at the scene is vital for future claims. Capture photos from various perspectives, document road conditions, and collect witness contact information. Such documentation fortifies your case when seeking compensation for damages. For a more detailed guide, refer to this resource to enhance your understanding of post-incident actions.

The Importance of Understanding Your Rights

For individuals entangled in car accidents, grasping their rights is paramount for securing legal safeguards. Acquaintance with these rights profoundly influences both the journey and the results within the insurance claims framework. It is imperative to comprehend the state-specific legal frameworks, especially in the pursuit of compensation for victims.

Legal Protections in Car Accidents

Each jurisdiction has enacted laws to safeguard those affected by car accidents. Familiarity with these statutes empowers victims to maximize the legal protections afforded to them. A critical step involves comprehending the role of insurance, particularly in relation to various coverage types. Seeking attorney advice for car accident insurance elucidates these complexities, potentially leading to more favorable outcomes.

Your Rights as a Victim

Victims are entitled to compensation for medical costs, lost earnings, and suffering. Navigating this terrain necessitates a grasp of the insurance claims process and the requisite documentation. Engaging a personal injury lawyer offers invaluable guidance through the complexities of these procedures, ensuring the preservation of your rights throughout the claim.

Navigating Car Insurance: The Basics

Grasping the intricacies of car insurance is imperative for individuals navigating the insurance claims process post-accident. The array of coverage options significantly influences the compensation for damages, necessitating a comprehensive understanding of each policy’s scope.

Types of Car Insurance Coverage

Car insurance encompasses a spectrum of coverage types, each tailored to address distinct scenarios. Acquaintance with these categories is instrumental in streamlining the claims process:

- Liability Coverage: Mandatory in many jurisdictions, it ensures financial responsibility for damages or injuries inflicted upon others.

- Collision Coverage: This provision compensates for vehicle damage, irrespective of fault in an accident.

- Comprehensive Coverage: It safeguards against losses stemming from non-collision incidents, such as theft or natural disasters.

- Personal Injury Protection (PIP): This coverage extends to medical expenses and lost wages for policyholders and their passengers, irrespective of fault.

Understanding Policy Limits

Each car insurance policy stipulates limits, defining the maximum liability the insurer undertakes in the event of a claim. Recognizing these limits is paramount for effective claims management. Should damages surpass your policy’s limits, you may be liable for the shortfall. Familiarity with car accident laws is crucial in navigating scenarios where policy limits are invoked, particularly when seeking compensation for damages.

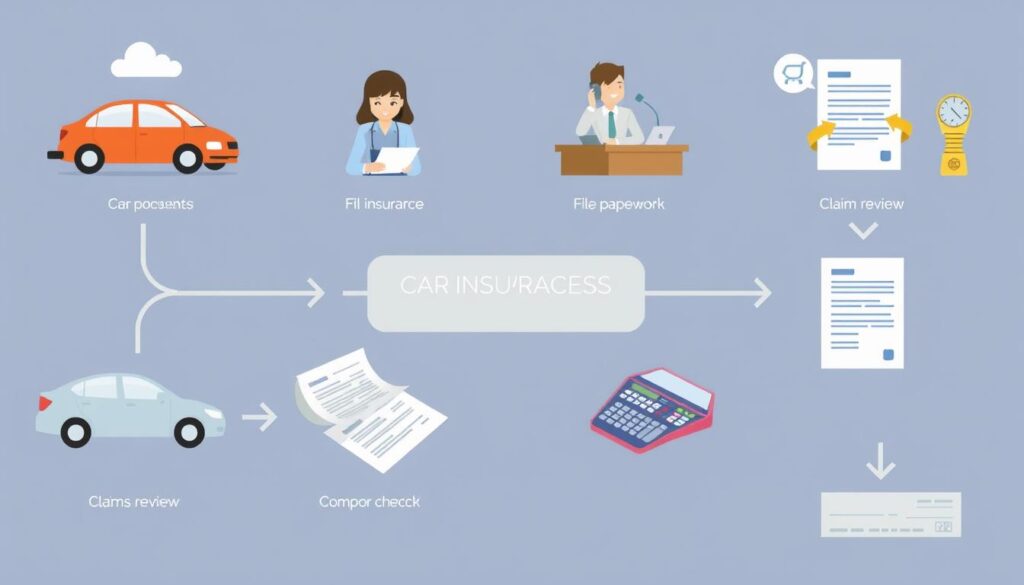

Filing a Claim: Step-by-Step Guide

Post-accident, the insurance claims process can appear formidable. Mastery of the claim filing process is imperative for equitable compensation. This guide delineates the critical steps, from incident reporting to documentation compilation.

Reporting the Accident to Your Insurer

Initiating the claims process necessitates immediate notification to your insurer. Prepare to furnish essential details:

- Your policy number

- Accident specifics, including date, time, and location

- Parties involved

- Police report numbers, if relevant

Accurate and comprehensive reporting is paramount. The data you provide will significantly influence your settlement. For detailed guidance on accident reporting, refer to this resource.

Collecting Necessary Documentation

Accumulating pertinent documentation is crucial for claim substantiation. Include:

- Police reports

- Medical records pertinent to your injuries

- Photographic evidence of the accident scene

- Witness impact statements

These documents are pivotal in pain and suffering claims negotiations, impacting compensation determinations. Adequate documentation can streamline the process, potentially enhancing your claim’s outcome.

Dealing with Insurance Adjusters

The intricacies of the insurance claims process can overwhelm individuals, particularly when encountering insurance adjusters. These professionals are adept at reducing payouts for their companies, necessitating a comprehensive understanding of the evaluation criteria. This discourse aims to elucidate the methodologies behind negligence determinations and furnish strategies for effective communication to ensure equitable treatment of your claim.

What to Expect During Adjustments

Engagement with insurance adjusters necessitates a meticulous examination of your claim. They scrutinize multiple facets, including:

- The specifics of the accident, encompassing police reports and witness testimonies

- Medical records and the associated costs of treatment

- The degree of property damage

- Any previous claims or histories of accidents

Adjusters’ evaluations hinge on negligence determinations, scrutinizing fault attribution for the accident. Grasping this concept facilitates more effective dialogue during the evaluation phase.

Tips for Communication

Optimal communication with insurance adjusters can substantially influence your claim’s outcome. Here are some indispensable tips:

- Be prepared: Compile all requisite documents and details pertinent to the accident.

- Stay calm and professional: Maintain composure during interactions.

- Stick to the facts: Offer precise information devoid of speculation.

- Ask for clarification: Inquire if any information is ambiguous.

- Consult an attorney: Soliciting attorney advice for car accident insurance can offer invaluable guidance in these interactions.

Common Misconceptions About Car Accident Claims

Grasping the true nature of car accident claims is imperative for those directly affected. Misconceptions can precipitate suboptimal decision-making and forego potential compensation. Below, we debunk two prevalent myths that often perplex victims as they navigate the intricate insurance claims process.

Myth: You Can’t File if You’re Partially at Fault

A widespread misconception posits that any fault in an accident precludes claim filing. This notion is at odds with numerous car accident laws that enable compensation even when victims bear partial responsibility. In many jurisdictions, the principle of contributory negligence allows individuals to seek damages, despite their fault contribution.

Myth: Insurance Companies Act in Your Best Interest

Another entrenched myth suggests that insurance companies always prioritize their policyholders’ interests. While some agents may offer attorney advice for car accident insurance, the reality diverges significantly. Insurance companies’ primary objective is financial gain. It is crucial for victims to remain vigilant and cognizant of their rights throughout the insurance claims process.

The Role of Attorneys in Car Accident Claims

Car accidents precipitate intricate legal conundrums, rendering the role of an attorney indispensable. The imperative to discern when to engage a personal injury lawyer is paramount for individuals confronting the aftermath of a collision. Procuring attorney advice for car accident insurance can markedly enhance a victim’s prospects for achieving satisfactory outcomes.

When to Hire an Attorney

It is prudent to contemplate the engagement of a personal injury lawyer in specific scenarios:

- Involvement in serious accidents resulting in significant injuries.

- Disputes with insurance companies regarding liability or compensation.

- Complex cases involving multiple parties or legal nuances.

These scenarios can be daunting, and the presence of a professional can mitigate some of that anxiety while safeguarding your rights.

Benefits of Professional Legal Advice

The benefits of soliciting professional legal counsel transcend mere representation. A personal injury lawyer can facilitate:

- Negotiation of equitable settlements that accurately reflect the true cost of your injuries.

- Navigation through the complexities of the legal system and paperwork.

- Ensuring the accuracy and timely submission of all necessary documentation.

Ultimately, legal representation augments the probability of obtaining compensation for damages while permitting the victim to concentrate on recuperation. For further elucidation on the impact of attorneys on claims, consider exploring the crucial role of car accident.

Negotiating a Settlement with Insurance Companies

The art of negotiating settlements with insurance entities is paramount in the resolution of car accident claims. A thorough comprehension of the insurance claims process, coupled with strategic negotiation tactics, can significantly elevate the prospects of a satisfactory outcome for victims.

Key Strategies for Effective Negotiation

Effective negotiation with insurance companies necessitates meticulous preparation. Implement the following strategies to refine your negotiation prowess:

- Compile comprehensive documentation of all accident-related expenses, encompassing medical bills and repair costs.

- Document any lost wages resulting from the incident.

- Detail the accident’s impact on your daily life, highlighting pain and suffering claims.

- Set a minimum acceptable settlement amount prior to negotiations.

- Employ clear and confident communication to effectively present your case.

Understanding the Value of Your Claim

Accurate valuation of your claim is indispensable. It encompasses both tangible and intangible elements:

- Calculate all medical expenses, therapy costs, and out-of-pocket expenditures.

- Evaluate lost wages and potential income loss due to work absence.

- Consider emotional distress and pain and suffering claims resulting from the accident.

Seeking counsel from experienced resources can offer additional insights into effective negotiation. Explore negotiation tips designed to navigate this intricate process. Armed with thorough preparation and a deep understanding, victims can effectively advocate for their rights, securing equitable compensation.

Understanding the Statute of Limitations

The statute of limitations is a pivotal concept within the domain of car accident claims, establishing the timeframe within which a claimant can legally pursue compensation. Each jurisdiction possesses its own deadlines, rendering it imperative for claimants to be cognizant of these timeframes to protect their entitlement to damages. Grasping these statutes not only facilitates the insurance claims process but also amplifies the efficacy of legal counsel in car accident insurance matters.

Timeline for Filing Claims

The statute of limitations for car accident claims varies across states, spanning from one to six years. Predominantly, states adhere to a two to three-year window, commencing from the accident’s occurrence date. Adherence to this timeframe is paramount, as neglecting to file within the stipulated period can lead to the forfeiture of one’s right to claim damages. It is imperative for individuals to expedite the collection of documentation and seek legal counsel promptly.

Exceptions to the Rule

Despite the apparent simplicity of the time limits, there exist notable exceptions that claimants must consider. For example:

- Minors: If a minor is involved in the accident, the statute of limitations is often extended until they attain adulthood.

- Discovery Rule: In cases where injuries are not immediately evident, the statute of limitations commences when the victim becomes cognizant of their injuries.

These exceptions highlight the significance of remaining informed about the statute of limitations. Claimants should consult with legal professionals to navigate their rights and ensure the timely submission of their claims.

Seeking Compensation Beyond Insurance: Legal Options

In the aftermath of a car accident, it is imperative to recognize that compensation avenues extend beyond traditional insurance claims. For those seeking additional compensation for damages, exploring the legal pathway of filing a lawsuit against the negligent party emerges as a viable option. This legal recourse can facilitate the retrieval of medical expenses, lost wages, and other damages not fully covered by insurance. Familiarity with car accident laws in your state is crucial, empowering you to grasp the potential outcomes of such lawsuits.

Exploring Lawsuits for Damages

Pursuing a lawsuit involves various stages within the insurance claims process, including evidence gathering and settlement negotiations. If the other party’s insurance does not adequately address your damages, a legal route may offer more comprehensive compensation for your injuries. It is essential to consult with a qualified attorney who specializes in such cases. They can assist in navigating the complexities of the legal system and fortifying your claim.

Utilizing Uninsured/Underinsured Motorist Coverage

Another critical aspect to consider is your own insurance coverage, specifically uninsured and underinsured motorist options. These policies act as a safety net when the at-fault party lacks sufficient insurance to cover all incurred costs. By leveraging this type of protection, victims can ensure they receive the compensation for damages they deserve, even when facing drivers without adequate coverage. Understanding these options not only provides peace of mind but also underscores the importance of being proactive in safeguarding your financial recovery after a car accident.